Leave a gift in your Will

Why a gift in your Will matters

Thank you so much for considering leaving a gift in your Will to Heart Research UK.

When we started over 50 years ago, more than 70% of heart attacks ended in death, but today at least 70% of people survive. Despite these great achievements we still have so far to go to prevent, treat and cure heart disease – it is one of the UK’s single biggest killers.

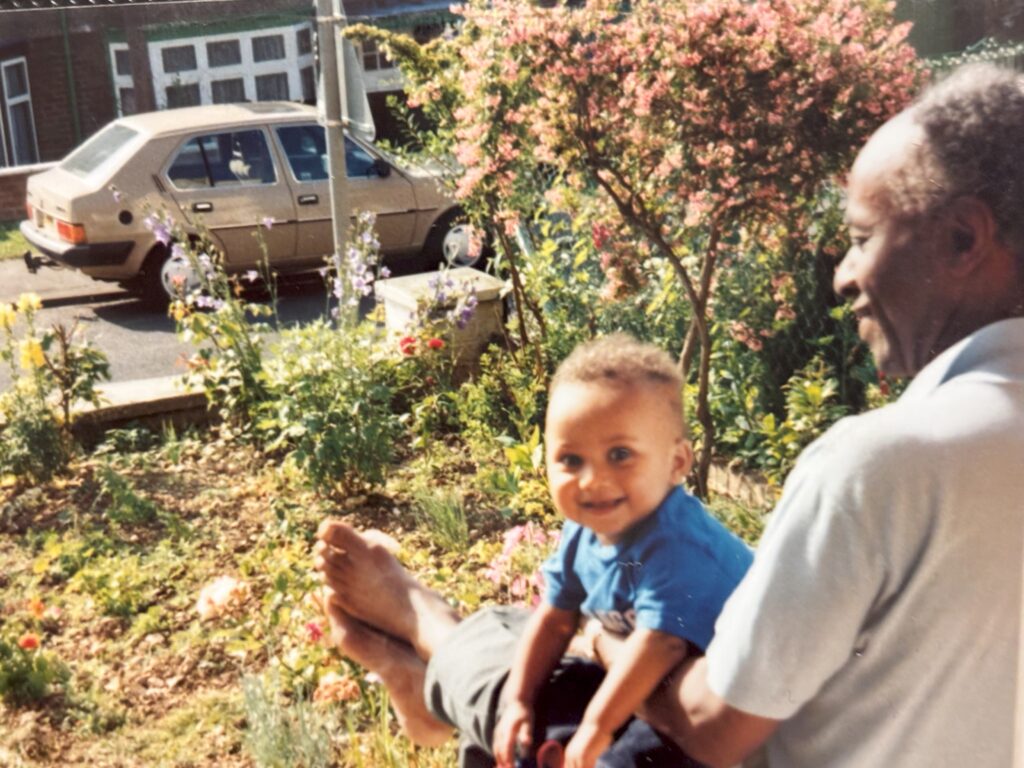

By leaving a gift in your Will, many more people will have healthier, happier, longer lives to enjoy with their family and friends. It’s more than just money – it’s life, hope and health for future generations.

Help tomorrow’s hearts today, with a gift in your Will to Heart Research UK.

Supporter stories

What to do next

Use our Will planner

Use our handy Will planner to help prepare for a meeting with your solicitor about writing a Will.

Use our free Will writing service

Make a free legally binding Will in 15 minutes. Each Will is checked by legal experts and can be updated any time, quickly and easily.

Find a solicitor

Solicitor’s will make sure your wishes are clear and can help you include a gift to us.

Use our suggested wording

Download our suggested wording and charity number to use if you decide to leave a gift in your Will to Heart Research UK.

Get in touch for more information

If you’d like more information call us on 0113 234 7474 or click on the button below to email Jess.

Order a free Gifts in Wills Leaflet

Order our free leaflet for more information and inspiration about leaving a gift in your Will to Heart Research UK.

Information for executors, trustees and solicitors

Read our FAQs

A Will makes sure your loved ones are taken care of and your wishes are clear. It makes things simpler for those you leave behind and avoids conflict at an already difficult time. If you don’t make a Will, the government decides how to share out your estate and they might not do it in a way you feel is fair or benefits the people and organisations you want to. You also can’t leave money to charity without a Will.

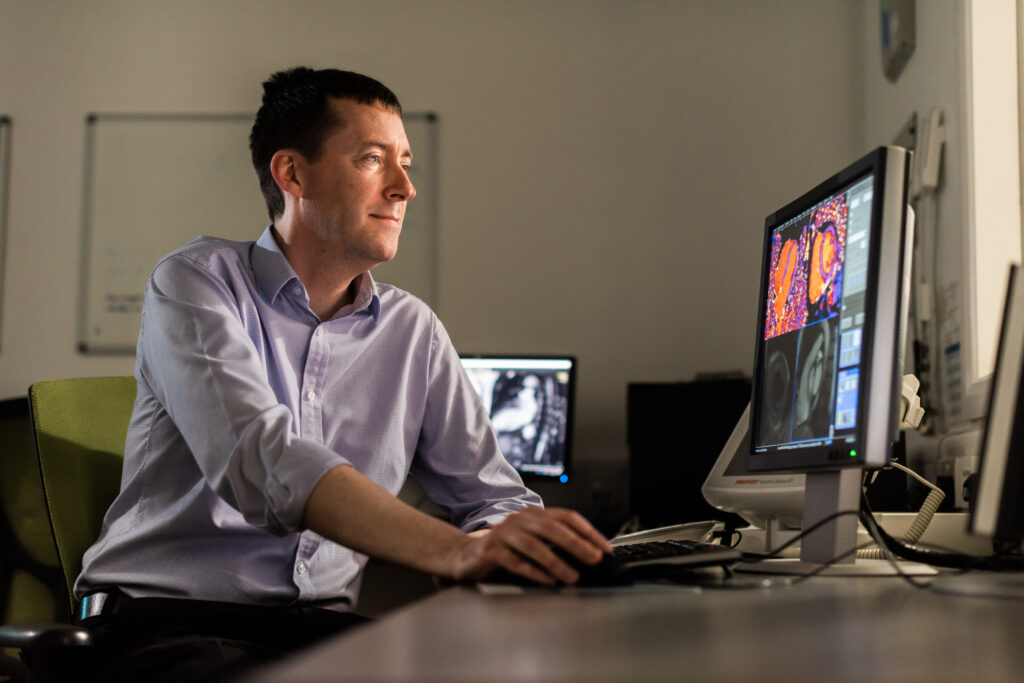

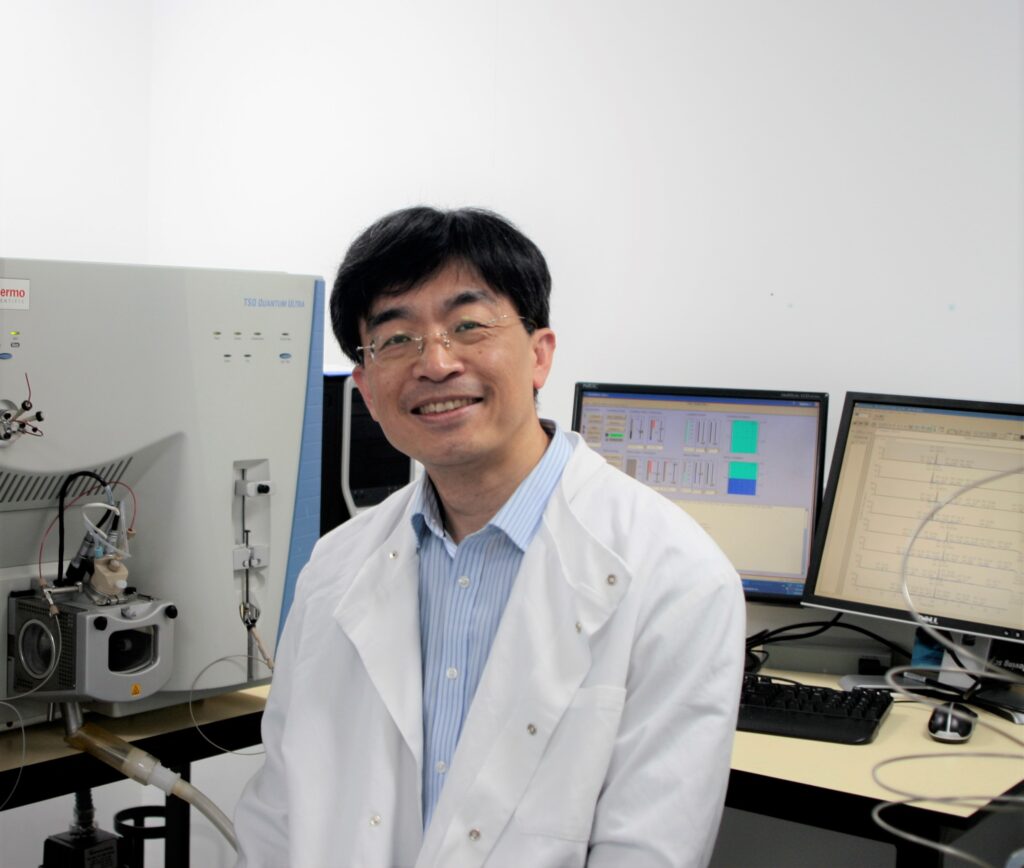

When Heart Research UK started over 50 years ago, more than 70% of heart attacks ended in death, but today, at least 70% of people survive. But we have so far to go to prevent, treat and cure heart disease – it is still one of the single biggest killers in the UK!

Over half of our work is funded by gifts in Wills and they enable us to make big plans for the future.

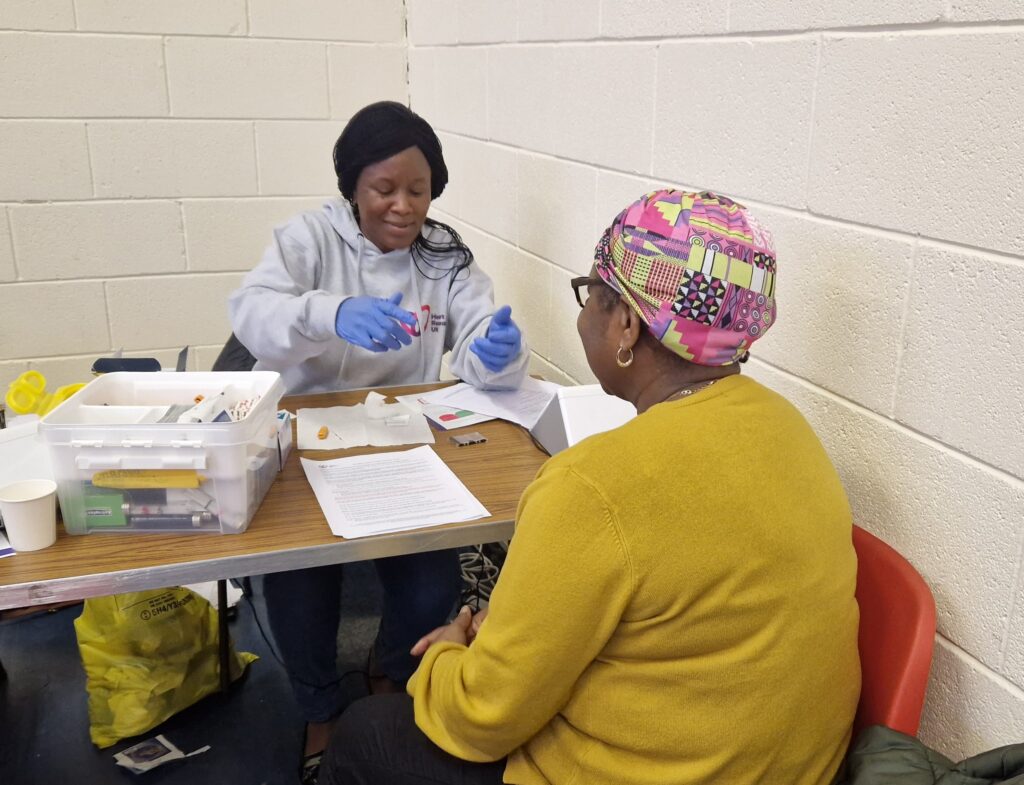

Heart Research UK want to continue to fund pioneering research projects, accessible education programmes and work in communities. We want to reduce the number of people developing and dying from heart disease, while improving and extending the lives of those affected. You can help achieve this by leaving a gift in your Will and helping tomorrow’s hearts today.

There are different ways of giving to charity in your Will, so you can choose the best one for you.

- A percentage or all your estate (the money and property you own once all other payments, gifts or deductions have been made).

- A fixed amount of money.

- A specific item of value such as possessions, property of shares.

Always speak to your solicitor and/or financial advisor when deciding what kind of gift to leave in your Will.

If you want to make a change to your existing Will by adding a gift to Heart Research UK, you can do this through your solicitor.

You may also be able to use a Codicil to change your existing Will. This is a document that allows you to make minor amends to a Will without needing to rewrite the original document which can be the more expensive option. However, Codicils are not always appropriate, and if you’re making significant changes, or if your Will is more complicated, it’s recommended that you make a new Will rather than use a codicil. Furthermore, if the codicil is not drawn up properly or kept in the right way, this can cause problems when it comes to executing the Will and even revoke the Will altogether.

We recommend seeking legal advice when considering using a Codicil. You can download our codicil form when this is considered the best option for you to change your Will and add a gift to Heart Research UK.

It’s best to speak to a legal advisor when writing your Will. Click on the button below to see the suggested wording we recommend taking to your solicitor if you decide to leave a gift to Heart Research UK.

You don’t have to tell us but we would love to hear from you if you have so that we can thank you properly. Simply send us an email to let us know you have left us a gift in your Will.

By leaving a gift to us in your Will, you can have more control over your money and save quite a hefty bill to the taxman. If your estate is worth over £325,000, the executors of your Will may have to pay inheritance tax at a rate of 40%. If you leave 10% or more of your estate to charity in your Will, the remainder of the estate will be taxed at a reduced rate of 36%.

If you think this could apply to you, you can calculate your predicted inheritance tax liability, and how this can be reduced with a gift to us using the government’s inheritance tax calculator. Always speak to your legal advisor if you think your estate may be liable for Inheritance Tax.

You can leave a gift to a particular area of work, for example research or education, or to be used in a particular area but the most valuable gifts are not restricted like this. This is because we don’t know exactly what will need funding in 5, 10 or 50 years’ time. Leaving your money unrestricted will allow us to put your money to best use, where it is needed the most. If you want to leave a gift to a specific area of our work, then please get in touch to discuss with us.

If you have any questions or want to know more about leaving a gift in your Will to Heart Research UK, give Jess a call on 0113 234 7474 or click on the button below to send Jess an email.